Our latest update regarding the Corporate Transparency Act can be found here.

The Corporate Transparency Act (“CTA”) took effect on January 1, 2024, which will impact millions of small businesses nationwide. This is a follow-up piece to our December article on the CTA and a reminder that many local businesses in Hawai‘i will have reporting obligations this year.

The CTA requires both foreign and domestic “reporting companies” to file beneficial ownership information reports (“BOI Reports”) to the US Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”), and disclose certain information about (i) the company itself; (ii) its beneficial owners; and (iii) the company applicant. Reporting companies include LLCs, corporations, or any other entities formed by filing a document with a secretary of state or other similar office, or a foreign company that is registered to do business in any state, and that does not qualify under one of the 23 exemptions enumerated in the CTA. Some of the common exempt entities include publicly traded companies, tax-exempt entities (as described in section 501(c) of the IRC), and large operating companies (20 or more full-time employees and more than $5,000,000 in gross receipts or sales). A list of the exemptions can be found on FinCEN’s FAQ website.

Deadlines for Reporting Companies to File

- Existing Companies: Existing companies (companies created or registered to do business in the U.S. before January 1, 2024), have until January 1, 2025 to file their initial BOI Reports.

- Newly created or registered companies (in 2024): Companies created or registered to do business in the U.S. in 2024 will have 90 calendar days to file their initial BOI Reports after receiving actual or public notice that the company’s registration or creation is effective.

- Newly created or registered companies (in 2025 and beyond): Companies created or registered to do business in the U.S. on or after January 1, 2025, will have 30 calendar days to file their initial BOI Reports after receiving actual or public notice that the company’s registration or creation is effective.

Updated Reports: Although there is no annual filing requirement for BOI Reports, if there are any changes to the required information previously submitted about the reporting company or its beneficial owners, the company must file an updated report within 30 calendar days after a change occurs.

Information Required for Each Beneficial Owner

- Full name;

- Date of birth;

- Residential street address;

- Unique identifying number from an acceptable identification document (e.g. passport, driver’s license); and

- Image of the identifying document.

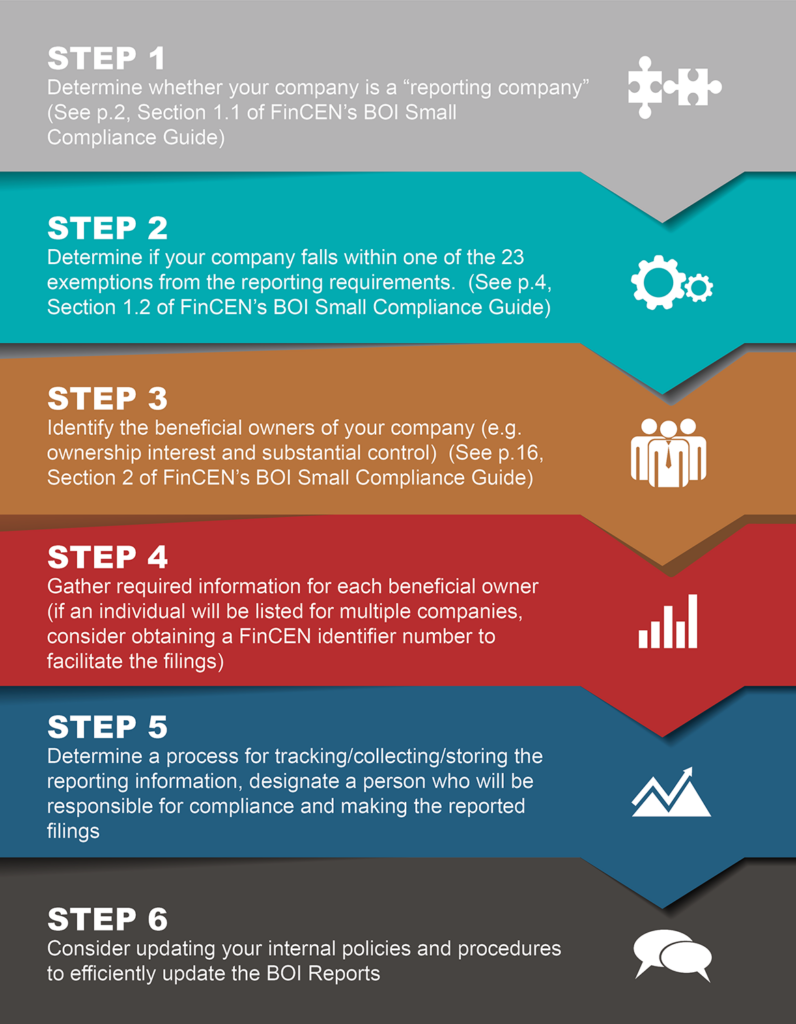

Steps to Prepare

Resources

Please find attached hereto some materials released by FinCEN to assist small business entities in working through these new reporting requirements. Attached is the latest “Small Entity Compliance Guide” available here and a list of FinCEN’s FAQs available here.

*Please note that the guidance, rules, and regulations concerning the CTA are constantly evolving and that the contents of this email are for general information purposes only and should not be construed as legal advice. For more comprehensive information or tailored advice, please seek counsel from a qualified attorney.